Artificial intelligence is everywhere in accounting conversations. Firms discuss it in partner meetings, vendors promise it in demos, and professionals experiment with it daily.

Yet when you look at how audits, reviews, and financial procedures are actually executed, very little has fundamentally changed.

The question is not whether AI exists in accounting. It does.

The question is why it has not reshaped the core of the profession.

AI is Being Used Around the Work, Not Inside It

Today, most accountants interact with AI in peripheral ways. Drafting emails. Summarizing documents. Generating first-pass explanations. Occasionally assisting with research or technical writing.

These uses are helpful, but they sit outside the actual execution of accounting work.

The core of the profession still looks the same:

- Data is extracted manually

- Documents are cross-checked line by line

- Exceptions are identified through sampling and experience

- Workpapers are assembled by hand, often under time pressure

AI helps communicate about the work, but it rarely participates in producing it.

The Trust Barrier is Real, and Justified

Accounting is a trust-critical profession. Errors have legal, regulatory, and reputational consequences.

As a result, there is deep skepticism toward systems that appear to “decide” or “judge” on behalf of professionals.

This skepticism is not resistance to technology. It is professional responsibility.

Many AI tools implicitly promise conclusions: classifications, risk assessments, judgments. That is precisely where accountants draw the line. No partner wants to sign off on an opinion generated by a black box.

As long as AI is positioned as a decision-maker, it will remain excluded from the core workflow.

Automation Alone is Not the Breakthrough

Over the past two decades, accounting software has focused heavily on automation. Rules-based checks. Templates. Macros. Standardized procedures.

These tools reduced friction, but they did not change the nature of the work. They accelerated tasks without improving understanding.

AI risks repeating the same mistake if it is treated as “automation, but smarter.”

The real limitation in accounting today is not speed. It is visibility.

Professionals often do not see risk early. They do not know where inconsistencies are forming until late in the process. They discover gaps when timelines are already compressed.

Faster execution of blind processes does not solve that.

Where AI Can Actually Fit

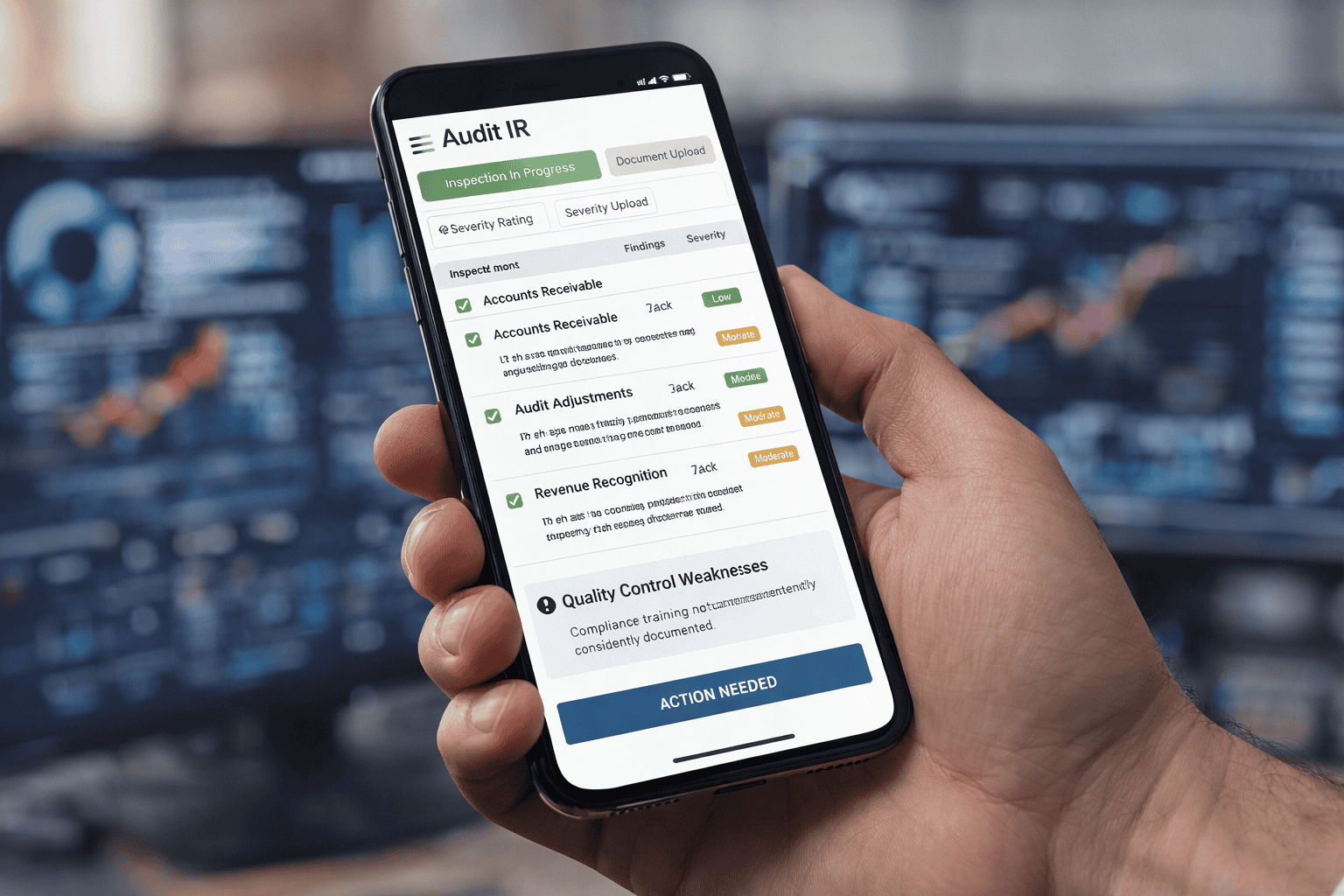

The most promising role for AI in accounting is not judgment. It is structure.

AI can:

- Ingest large volumes of financial and supporting data consistently

- Cross-reference information across sources that humans struggle to compare at scale

- Surface anomalies, inconsistencies, and gaps without interpreting them

- Maintain a continuously updated picture of what has been reviewed and what has not

In this model, AI does not replace professional judgment. It sharpens it.

The accountant still decides what matters. The system ensures nothing important is missed.

From Hindsight to Real-Time Awareness

Traditional accounting workflows are backward-looking. Risk is often assessed after data has been processed and documents assembled.

AI enables a different posture: continuous awareness.

Instead of discovering issues at the end of the process, professionals can see signals as data arrives. Instead of sampling blindly, they can focus attention where patterns actually deviate.

This does not reduce accountability. It increases it.

Better visibility leads to better questions, better documentation, and stronger conclusions.

Why This Shift is Slow, but Inevitable

Accounting systems were not designed for this kind of intelligence. They evolved to store data, not to reason over it. Retrofitting AI into legacy workflows is hard.

But pressure is mounting:

- Data volumes continue to grow

- Talent shortages increase workload

- Expectations for audit quality and insight rise

At some point, incremental improvements stop being enough.

The firms that succeed will not be the ones that “use AI the most,” but the ones that integrate it correctly: quietly, structurally, and in service of professional judgment.

The Real Transformation

The real AI transformation in accounting will not look dramatic.

There will be no replacement of professionals, no automated opinions, no elimination of responsibility.

Instead, there will be something far more valuable: clarity.

Clear visibility into data. Clear understanding of risk. Clear evidence behind every conclusion.

That is not hype. That is progress.